Get your Renters to Pay Rent Online: Top Objections and How to Overcome Them

Convincing your existing renters to pay rent online is straightforward once you know their concerns. Here are the top objections we’ve heard raised by renters when it’s time to pay rent online.

Silence

Silence is the toughest thing to hear when you ask your renter to start with a new payment system. This isn’t an objection per se, but here’s how to deal with it.

Your renter may be too busy to respond, or they may not have received your message, or they may be hoping you’ll forget the request. They may want to continue paying rent by cash, check, or money order. In any event, you’re going to be left wondering what is going on.

If it’s the case that your message wasn’t received, or it was received at a time when your renter was too busy to act on it, then persistence across multiple channels is needed. You can send a letter this week, send an email next week, send a text a couple days later, call, and go visit in person. Each communication references the other, inviting them to reply, “Oh, my phone number changed.” This is “renter communication 101.”

If your renter is getting your messages but seems uninterested, then it’s probably an issue of not seeing any reason to change. “I already have the apartment. My landlord won’t seriously say ‘no’ to a check. Why should I bother?” This can be overcome by offering a benefit to paying rent online, see below under, “There’s nothing in it for me.”

Finally, renter reluctance may be a specific objection to a condition of the service. Which leads us to the list of real objections.

“I don’t want to pay rent online because I don’t trust banks”

Believe it or not, a significant minority of renters would agree with the statement “All banks are thieves.” Bank fees hit lower income renters especially hard. Think about how a $3 overdraft can result in a $30 overdraft fee, and then think about the second charge that day that creates a second fee. Banks do little to generate goodwill among low income or cashflow-challenged customers.

Renters who don’t want to participate in banking will be more ready to sign with a rent collection service that does not require a bank account, that guarantees no overdraft fees, or that somehow helps a renter avoid charges, hidden or otherwise. Take caution when considering a rent collection service that doesn’t disclose costs because “the renter pays.” These sound great to owners, but they usually struggle to get renter engagement.

“I don’t have a computer/email/smartphone”

Obviously Internet access is important for many people, but this is not true for all, especially not the elderly or low-income households. Many rent collection services require an email address or even online banking. These can be big challenges for folks who haven’t been exposed to computers or taught how to use them. Renters who don’t have an email address will be unreachable with most services to pay rent online.

You can require renters to have an email address. But note that a policy of requiring email or computer access may discriminate against a protected class. Federal case law from a Texas case establishes that “disparate impact” discrimination claims can now be brought in housing. In a nutshell, this means that a valid business requirement (e.g., having an email address) can be found to be discriminatory if the effect is to exclude members of one protected class much more frequently than another.

The best way to pay rent online should still let renters participate even if they have no email address, no computer, and no smartphone.

“I don’t control the money”

This issue can come up with subsidized renters, where the renter’s portion of the rent payment will be below the minimum required to pay rent online. Few services have minimums, but read the fine print to be sure. Another far less common issue is when a renter operates under guardianship, meaning someone else pays their bills for them. In these situations, you need to talk to the guardian to see if they can access the rent collection service you have in mind.

The best way to pay rent online should work with guardianship and subsidized rentals.

“There’s nothing in it for me”

This is the biggest reason renters choose not to pay online. It’s easy and customary to write a check or get a money order, or to pay in cash because that’s how the renter themselves got their income. Especially for renters who don’t use the Internet often, having to pay rent online could be like going far out of their way.

The best way to pay rent online should offer something to the renter. For instance, if the service reports rental payments for credit, then renters who pay rent online can now build credit just by doing what they were already doing. This is a great example of moving past inertia and into a new rent collection system.

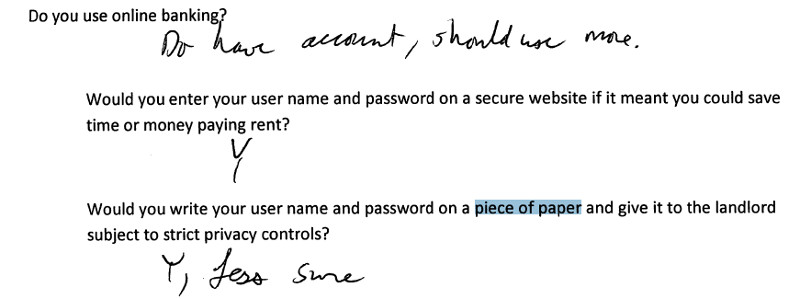

RentHelper conducted surveys of real-world renters to evaluate access to banking systems, awareness of security issues, trust of banking and landlords, etc.

Switching from Cash/Check/Money order to Paying Rent Online

With new renters, it’s easy to require paying rent online. As long as your system isn’t likely to draw a disparate impact discrimination claim, see above, you can screen for willingness to pay rent online and disqualify rental applications that are unwilling. This gradual approach will start the new system with your next turnover. Every unit that turns over after will also become an online payer.

For existing renters, especially long-term renters, you need to understand the common objections renters will raise and how to overcome them. Select a rent collection service that overcomes these objections and communicate with your renters. Or better yet, select a rent collection service that will explain the benefit to your renters for you.